Feb 17 2013

The Belgian-Chinese Chamber of Commerce (BCECC) and the Belgium-Hong Kong Society

IF you are interesting on event of the Belgian-Chinese Chamber of Commerce (BCECC) and the Belgium-Hong Kong Society. Please let us know.

Dear Mr. Milar,

In light of the Business of Design Week (BoDW) that will take place from December 2 to December 7, 2013 in Hong Kong, the Belgian-Chinese Chamber of Commerce (BCECC) and the Belgium-Hong Kong Society (BHKS) are pleased to invite you to a networking event with a business delegation from, amongst others, the HK-SAR Government, HK Trade Development Council, HK Design Center, HK Design Institute, Polytech Institute and HK Ambassadors of Design on March 5, 2013 in Brussels.

Belgium being elected “Partner country” to the BoDW 2013 is an acknowledgement of our importance in the global world of creativity. This event promises a valuable platform for Belgian design-related business. This prestigious project, under the name of Belgian Spirit, is an organization of our 3 regional governments and related partners.

Who Should Attend?

– Champions and connoisseurs of design

– Start-ups and SMEs looking for inspiration

– Entrepreneurs, innovators, highly-motivated business leaders

– CEOs and senior management interested in unleashing the power of design

– Policy makers and influencers, trade association leaders

– Academics and design educators

– Students and all creative individuals

Please find attached a list of the coming delegation.

Program:

16.00-16.30: Registration

Welcome words by Bernard Dewit, Chairman of BCECC

Welcome words by Mr Piet Steel, Chairman of BHKS

Welcome words by Victor Lo, Chairman of the Hong Kong Design Centre

17:00-17:15: Presentation Belgian Spirit Project

17.15-18.30: Networking reception/cocktail

Venue:

Sheraton Brussels Airport Hotel

Brussels National Airport

1930 Brussels

Located across the departure halls of the airport.

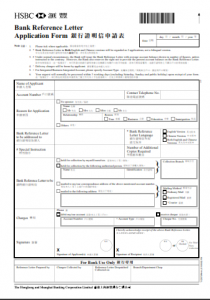

Interested in joining us? Subscription fee for BCECC and BHKS members is 35€/person and 70 €/person for non-members. Please register before the 1st of March by sending the filled in registration form to events@bcecc.be or by faxing it to 02 649 04 39.

Looking forward to meeting you there!

Best regards,

Recent Comments